Background and Terms of Reference

Following CDB’s adoption of the PBL instrument in 2005, multitranche policy-based loans were made to Antigua and Barbuda, Belize, Grenada, Jamaica, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines over the period 2006–2009, with an approved total of $242.8 million. In 2010 CDB’s Evaluation and Oversight Division9The Evaluation and Oversight Division (EOV) was until 2011 a unit reporting to the Vice President of Operations. A new Evaluation Policy converted it into the Office of Independent Evaluation, reporting to the Board, beginning in 2012commissioned a review of experience with the PBL instrument to date. The overall objective was to assess:

(i)design and inputs, consistency with other operations, validity of underlying assumptions, and whether it addressed the relevant development constraints;

(ii)ownership and the extent to which governments were fully committed to, directly involved in, and accountable for the program of policy reforms;

(iii)conditionalities and the ability of the country to meet loan conditions within the time frame specified

(iv)the effectiveness of monitoring and supervision by CDB;

(v)the effectiveness in achieving the results when there is failure to meet conditionalities;

(vi)the level of consultation and partnership in design and implementation; and

(vii)the role of CDB and the rationale for PBL financing in relation to the activities of the World Bank, the Inter-American Development Bank (IDB), the International Monetary Fund (IMF) or other relevant international financial institutions operating in the BMCs.

The terms of reference did not mention the Development Assistance Committee of the Organisation for Economic Co-operation and Development (OECD-DAC) evaluation criteria or require a rating of performance, but rather they focused on lesson learning and recommendations for improved implementation. An individual consultant with a background in public finance, fiscal policy, and banking systems was engaged. The consultant conducted a document review, interviews with Board members and staff, and country visits to meet with senior officials and heads of agencies charged with implementing PBL prior actions.

Review Findings

Context and analytic framework. The review observed that PBOs over the 2006 to 2009 period were transacted in part due to imminent fiscal crisis, and in part out of national political will for a longer-term reform and social protection. The main influencing conditions were:

- the emergence of fiscal pressures as expenditure and debt commitments outstripped revenue by amounts in excess of available financing on prudent terms;

- an assessment that the financing gap was not quickly reversible and that measures being taken to address it would take time to yield results;

- a judgment that financial support already finalized or being discussed with other lenders and donors would not be delivered in time to avert a potential payments crisis; and

- a conviction that a PBL would ease the immediate fiscal pressures, forestall a potential budget crisis, and allow time for the country to implement policies that would provide lasting stability and improved growth potential.

CDB’s analytical basis for its PBL lending at the time, shared by other multilateral development banks (MDBs), recognized the pervasive role of the public sector in economic development in small developing countries, and particularly the way in which government policies affect private behavior, investment, and growth. Since these policies were implemented through the national budget and the activities of government-controlled entities, fiscal policy could have a profound influence on growth and the pace of development.

At the same time, it was recognized that a focus on fiscal policy, public sector management and reform, and debt sustainability, while necessary, was not sufficient to achieve lasting stability and growth, particularly in the 2–3-year timeframes of PBOs. Other factors, including good governance and credible institutions governing law and order and property rights, can be equally important.

Design process. Typically, a cross-sectoral team of CDB staff visited the country in question for one week. It reviewed the economic situation and policies, focusing on public finances, debt, and the government’s program of adjustment and reform. The macro-fiscal framework and projections were developed, often with inputs from the work of other institutions, including the Eastern Caribbean Central Bank (ECCB), the World Bank, the IMF, and other development partners. In addition, TA needs for diagnostic work or program implementation were assessed, taking into account TA from other providers, including the Caribbean Regional Technical Assistance Center (CARTAC).

The review found that staff had collaborated closely with country officials and staff of other MDBs, the IMF, and the ECCB on program design, including the macroeconomic framework; projections over the medium term; debt sustainability analyses; and appropriate policies or actions to be incorporated in PBL conditions. It stated that analytical work on topics relevant to the objectives of the PBOs, such as the impact of debt restructuring and the effects of the global financial crisis had been noteworthy.10CDB’s analytical work on debt dynamics in Jamaica, for example, helped catalyze contributions from the IDB and World Bank in this area.The staff analysis of the likely impact of PBL on poverty and the social sectors was frank and well informed.

All or most of the policy actions included in a loan proposal were expected to have originated from the country’s own economic reform program, with explicit consideration of the likely impact on social conditions and poverty. In cases where other lenders were present (usually the World Bank or IDB) disbursement conditions were to have been calibrated to achieve consistency across institutions and avoid “conditionality arbitrage.”

However, two areas in program design needed attention: (i) the specification of PBL objectives and likely outcomes; and (ii) the treatment of assumptions and macroeconomic projections. Since clarity was essential for program design, conditionality, and monitoring and evaluation, there was a need for a clearer explanation PBL objectives, creating a stronger basis for the assessment of performance. Furthermore, further refinement of the techniques for macroeconomic and fiscal projection, including explanations of the basis for key assumptions and projections, was also needed to sharpen the analysis and bolster the credibility of the PBL instrument.

Conditionality. The review summarized the guidance on conditionality from various CDB documents:

(i) Dialogue with a wide cross-section of country officials was critical to identifying and designing conditions that reflected a strong commitment to reform, and that could be achieved during the implementation phase

(ii) Structural changes and institutional strengthening take time, and a PBL should reflect this. The activities to be undertaken during the disbursement period should be within the implementation capacity of the borrower and should be capable of being monitored

(iii) The conditions and associated activities need to be clearly defined and time-bound

(iv) Conditions should consist only of actions critical for achieving program objectives.

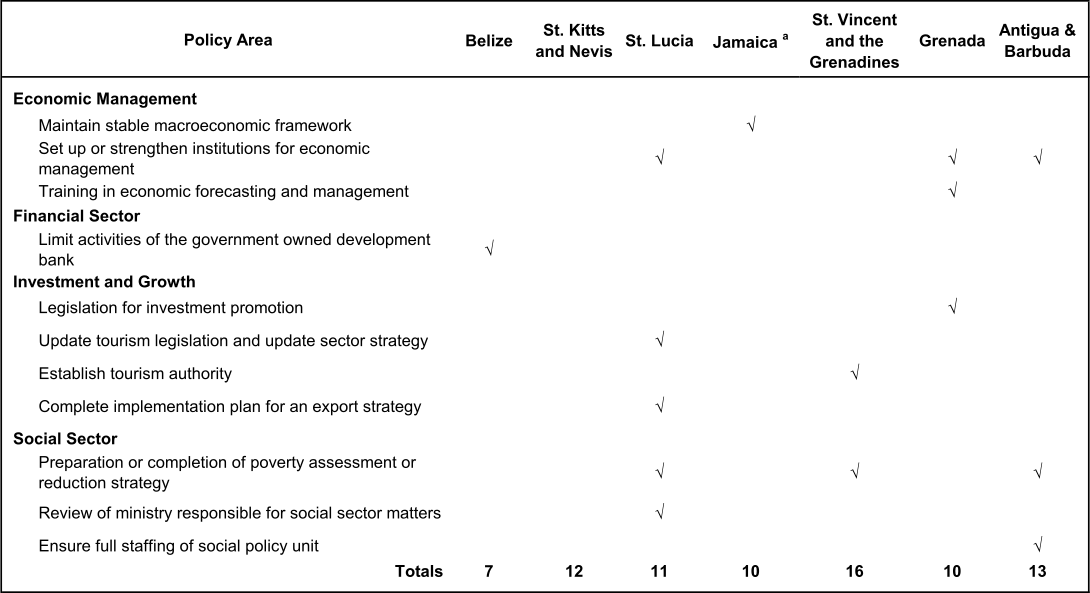

The seven PBOs to 2009 were multitranche operations. Most conditions (about 80%) related to fiscal policy, public financial management (PFM), and debt management, with measures in other areas (economic management, investment and growth, and the social sector) accounting for an average of about 6% each (Table 5.2). Under the fiscal and debt umbrella, most types of conditions were in the revenue category followed by measures covering PFM, debt management, and expenditure.

The average number of conditions for disbursement of the first tranche of PBL operations was 10, with the figure rising from five in the first PBL to Belize in 2006 to 15 in the case of Grenada in 2009. With regard to total conditions (covering first- and second-tranche disbursements), these increased from nine for Belize to an average of 30 for St. Lucia and Grenada, with a pronounced backloading of conditions, particularly in the case of St. Lucia. A large number of conditions were included in some of the PBOs.11By comparison, a $450 million development policy loan by the World Bank to El Salvador for public finance and social sector reform, approved in January 2009, contained a total of 14 disbursement conditions for two tranches.In small countries with limited capacity, the requirements were viewed as overly burdensome.

Table 5.2. Conditions in Caribbean Development Bank Policy-Based Loans, 2006–2009

* First tranche condition only has listed in Board documents

Country performance on conditions. Compliance with first-tranche loan conditions during 2006–2009 was mixed. Three of the six borrowing countries (Belize, Grenada, and St. Vincent and the Grenadines) met all their conditions without waivers, postponements, or adjustments and were able to draw down their first-tranche disbursements within about 2 months of the date of the loan agreement. Jamaica also secured a rapid disbursement after adjustments to its initial policy matrix, in part, to ensure consistency with the conditions of the World Bank’s development policy loan. Of the remaining countries, St. Lucia’s first-tranche disbursement took place following CDB’s agreement to re-program five conditions to the list of second-tranche conditions. In St. Kitts and Nevis, after a delay of more than 1 year from the signing of the loan agreement, the first-tranche disbursement took place following a waiver of one of the conditions.

Observations on loan conditions. An important contribution of the review was to gauge the depth of “ownership” of PBL conditions and reforms, as expressed by senior national officials. Some key messages emerged:

(i) The collaborative manner in which CDB staff arrived at a consensus on loan conditions withnational officials and other MDBs was appreciated

(ii) Loan conditions helped mobilize domestic support for key reforms. However, PBL conditions sometimes incorporated policy commitments which were not yet fully developed, or for which a domesticconsensus had not yet been achieved, which adversely affected ownership

(iii) here was a tendency to overestimate domestic capacity as well as the speed of TA delivery and government processes, including Cabinet decision-making and the drafting and approval of legislation.A smaller number of disbursement conditions would have been preferred. Policy actions requiring TA delivery should have been excluded until the arrangements for the funding and delivery of the TA had been finalized.

(iv) Given uncertainties in reform progression, more flexibility in applying second-tranche conditions was needed.

The evaluator added some summary reflections regarding CDB’s use of conditionality:

(i) Rather than multitranche operations, CDB should consider designing single-tranche PBL, withsubsequent operations and disbursements being consistent with an agreed medium-term strategy (this was later to be called the “programmatic approach”).

(ii) Caution should be exercised when requiring legislation as part of loan conditions. While legislation often needs to be updated or introduced as part of the process of reform, it is important to avoid a drift toward treating legislation alone (or action plans) as substitutes for real progress

(iii) Given the high incidence of poverty and inequality in the Caribbean and the importance of poverty reduction and social progress in CDB’s objectives and strategies, greater efforts should be made to include conditions aimed at achieving social objectives or mitigating adverse effects from adjustment and reform measures.

Monitoring and supervision. Overall, the assessment found that CDB’s procedures for monitoring and supervising its policy-based loans had not kept pace with PBL operations. Procedures were built on pre-existing systems for investment lending and had been insufficiently adapted to the PBL instrument. Reporting by staff to senior levels in CDB was ad hoc. Reporting required of borrowers in loan agreements (on macroeconomic indicators every quarter for 5 years) was viewed by countries as burdensome and therefore not regularly submitted.

Conclusions and Lessons

The review noted that loans had facilitated improvements in frameworks for macroeconomic management, fiscal policy, debt management, and overall public financial administration. Also, revenue systems had been modernized and debt restructuring facilitated. In addition, through their TA components, PBOs had helped strengthen capacity in areas, including macroeconomic forecasting, budgeting, and debt management.

The review observed that PBOs require careful consideration of feasible policy options, and analytical skills that can mold these into credible loan operations. They also require clear objectives and focused conditions, with specific, measurable goals, particularly in PBOs which are part of joint policy support operations with other MDBs. Goals need to be clear, realistic, and modest with greater consultation in setting loan conditions that are few in number and well defined. A series of discrete, well-defined steps toward reform, supported by a single-tranche PBL, might be more effective than a multitranche loan based on a hopeful set of longer-term commitments. A development bank with a commitment to improving social conditions should not shy away from incorporating social sector conditionality in its policy work.

Recommendations

The review offered four main recommendations:

(i) Focus PBL operations on public sector reform or social sector priorities which are not already covered by policy loans from other MDBs.

(ii) Specify the objectives of the PBL more clearly and pursue analytical work that can support improved program design and conditionality.

(iii) Adhere to the principles of parsimony and sharper the focus on disbursement conditions. The requirement for legislation as part of loan conditions should be used sparingly.

(iv) Develop guidelines specific to the monitoring and supervision of PBL.

- 9The Evaluation and Oversight Division (EOV) was until 2011 a unit reporting to the Vice President of Operations. A new Evaluation Policy converted it into the Office of Independent Evaluation, reporting to the Board, beginning in 2012

- 10CDB’s analytical work on debt dynamics in Jamaica, for example, helped catalyze contributions from the IDB and World Bank in this area.

- 11By comparison, a $450 million development policy loan by the World Bank to El Salvador for public finance and social sector reform, approved in January 2009, contained a total of 14 disbursement conditions for two tranches.