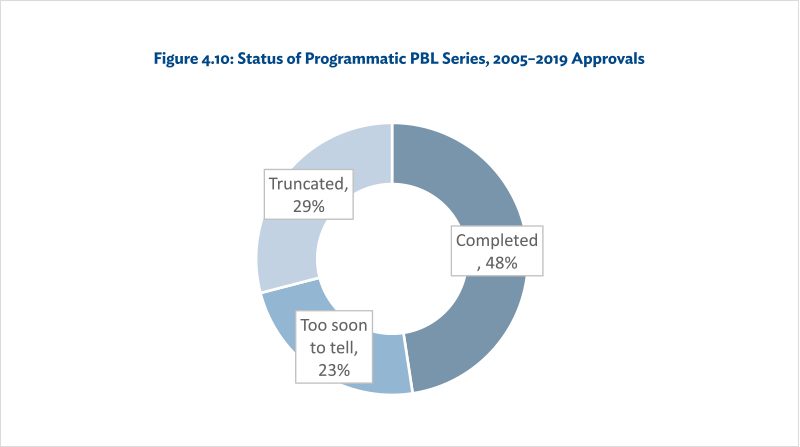

Over one third of programmatic PBL series approved since 2005 have been truncated. OVE’s 2015 review of the design and implementation of PBL operations at IDB found that 32% of active programmatic PBL series between 2005 and 2014 had been interrupted, while 40% had been completed and the remainder were still active, resulting in a truncation rate of 44% (truncated series as a share of completed plus truncated series). An OVE update of this analysis to cover PBL programs approved through 2019 showed only marginal improvement in series completion. Of the 124 programs active between 2005 and 2019, 59 have been completed, 36 have been interrupted and 29 are still ongoing (Figure 4.10, Table 4.3), resulting in a truncation rate of 38%. The truncation rate increases with the number of operations in a series: it is 33% for series with two operations, but 43% for series with three or more operations.

There are significant variations in truncations across countries. For example, Colombia had 16 series between 2005 and 2019 and a truncation rate of over 54%, while Peru with a similar number (15) of programs had a truncation rate of 8%. OVE country program evaluations showed that, in countries with high numbers of truncated series (e.g., Colombia and Panama), IDB often engaged in a new series in a different sector after a series has been truncated. Since medium- and high-depth conditions tend to be concentrated in the second and third loans of a series, the truncation of a series impairs the program’s depth. OVE’s 2015 review of the design and use of PBL found that the truncation rate was higher when there was a change in government, yet almost 20% of programs had been started within a year of elections and over 40% had been started within 2 years of elections, raising questions about IDB’s timing of programs.

Table 4.3: Status of Programmatic PBL Series by Program Size, 2005–2019 Approvals

| Number of Planned Operations in Series |

Completed |

Too Soon to Tell |

Truncated |

Total |

| 2 |

34 |

22 |

17 |

73 |

| 3 |

24 |

7 |

18 |

49 |

| 4 |

1 |

0 |

1 |

2 |

| Total |

59 |

29 |

36 |

124 |

Source: IDB Office of Evaluation and Oversight (OVE), based on data from IDB databases.

In a programmatic PBL series the policy matrix of each operation outlines the conditions applicable to the loan in question, as well as indicative conditions (called triggers) for subsequent loans in the program. In its review, OVE compared the actual policy conditions in second and third loans in a sample of 28 programmatic PBL series to the most up-to-date indicative triggers and found that about half of the triggers had changed during implementation, reflecting the flexibility of the programmatic instrument (Table 4.4). In terms of policy and institutional depth, for about 14% of the triggers in the second loans, and 19% in the third loan, the depth was found to have been reduced when the loan was approved. Conversely, the depth of conditions rarely increased.

Table 4.4. Changes to Disbursement Triggers and Policy Conditions in 28 Programmatic PBL Series

| Changes |

Loan 2 |

Loan 3 |

| Condition unchanged |

54.5% |

33.6% |

| Condition changed but same depth |

13.2% |

21.2% |

| Condition added |

12.9% |

21.2% |

| Depth decreased |

14.1% |

18.6% |

| Depth increased |

5.7% |

5.3% |

| Number of policy conditions |

335 |

120 |

Source: Based on IDB Office of Evaluation and Oversight (OVE). Design and Use of Policy-Based Loans at the IDB. Document RE-485-6. Washington, DC: IDB. https://publications.iadb.org/en/ove-annual-report-2015-technical-note-design-and-use-policy-based-loans-idb