IDB offers three broad lending categories among its sovereign-guaranteed loans. Investment lending (INV), policy-based lending (PBL), and lending for financial emergencies during macroeconomic crisis, called special development lending (SDL). In addition, IDB can also guarantee loans made by private financiers for public sector projects. PBL provides fast-disbursing financial assistance or country budget support that is conditional on the borrowing country fulfilling a set of agreed upon policy and institutional reforms, while investment loans disburse against specific predefined project expenditures. SDLs also provide fast-disbursing support and are conditional on a country having been struck by a macroeconomic crisis, being supported by an active IMF program, and the SDL being part of an international support package.

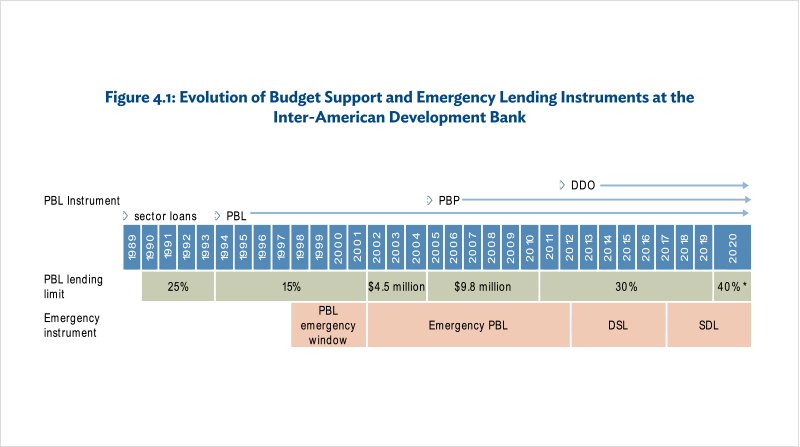

IDB introduced PBL at the time of its seventh capital replenishment in 1989, in response to the Latin American and Caribbean (LAC) debt crisis of the 1980s. It was based on the model of conditional budget support created by the World Bank almost a decade earlier. Originally called sector loans, IDB’s PBL was intended to support the twin objectives of promoting policy or institutional reform and helping countries meet their financing needs. PBL was introduced to help countries pursue macroeconomic adjustment programs while supporting structural reforms. PBL was to be disbursed in several tranches and was conditioned on the maintenance of a sustainable macroeconomic policy framework and compliance with a set of agreed-upon conditions defined in a policy matrix. PBL processes required a country policy memo to ensure that the conditions were being complied with and relied on IMF-supported programs for macroeconomic assessments. Policy-based lending was capped at a maximum of 25% of IDB’s 1990–1993 overall lending program. By the time of its eighth capital replenishment in 1994, IDB concluded that the need for major macroeconomic adjustment in the Latin America and Caribbean region had declined and that PBL should place greater emphasis on social sector policy and the efficiency of service delivery. To reflect this, the term sector loans was changed to policy-based loans and the cap was reduced from 25% to 15% of the lending program. The effects of the Asian financial crisis in 1997–1998 made adhering to the new cap difficult and led to the introduction of a transitory emergency variant of PBL, which was subject to a separate limit. The emergency program ended in the early 2000s, but demand for PBL continued to exceed the 15% limit. This led to three modifications in 2002: the 15% ceiling was replaced by an absolute figure of $4.5 billion for 2002–2004 (meaning that PBL lending became independent from the level of investment lending);1

a new emergency lending category, now separate from PBL, was introduced; and a minimum disbursement period of 18 months across tranches was established for PBL, mostly to avoid crowding out the new emergency instrument. Moreover, IDB started to supplement the traditional policy matrix with a matrix of results in its PBL loan documents.

By the mid-2000s, as borrowing countries were experiencing higher growth, increased institutional capacity, and better access to capital markets, IDB introduced three main changes to PBL. First, IDB made a progressive move to expand its own analysis of the adequacy of countries’ macroeconomic frameworks and reduce its dependence on the IMF’s views. This led to the creation of the “independent macroeconomic assessment,” which required the regional departments (supported by the Research Department) to produce a macroeconomic assessment at the time of approval and disbursement of PBL. In practice, however, IMF views continued to be a key input to IDB’s assessment.2

Second, the 18-month minimum disbursement period for PBL was removed. Finally, a programmatic variant of PBL, called programmatic policy-based loan, was introduced. The programmatic version consists of a series of single-tranche operations set in a medium-term framework of reforms. The first operation identifies the policy conditions for that operation as well as indicative triggers for the subsequent loans in the series. Since the triggers can be revisited at the time of loan approval, programmatic PBLs allow for conditions to be adjusted as circumstances change. With these changes, IDB also approved guidelines for the preparation and implementation of PBL, thus consolidating existing policies and practices for the first time.

* temporary in response to COVID-19.

DDO = deferred draw-down option, DSL = development sustainability credit line, PBL = policy-based loan, PBP = programmatic policy- based loan, SDL = special development loan.

Source: Based on IDB Office of Evaluation and Oversight (OVE). Design and Use of Policy-Based Loans at the IDB. Document RE-485-6. Washington, DC: IDB. https://publications.iadb.org/en/ove-annual-report-2015-technical-note-design-and-use-policy-based-loans-idb

More recently, PBL lending limits have been raised further and a deferred draw-down option has been added. The dollar-denominated cap on PBL established for 2005–2008 was initially extended for 2009–2012, but in 2011 the ceiling for PBL was changed to 30% of total approved lending. More recently, to facilitate IDB’s response to the COVID-19 crisis, the ceiling has been temporarily increased to 40% of total lending through 2022.3

In 2012, IDB also introduced a deferred draw-down option (DDO) to synchronize proceeds with countries’ financing needs. The DDO allows countries, on payment of an up-front premium, to draw on the resources of PBL when they require these funds. During the drawdown period, the borrower must maintain policy conditions and sustainable macroeconomic policies. In 2014, further actions were taken to decouple IDB’s PBL lending from the IMF’s assessment of macroeconomic conditions. IDB decided to strengthen its own macroeconomic assessment capacity and no longer make PBL lending conditional on an on-track IMF program, Article IV, or IMF letter of comfort.

On the emergency lending side, a temporary emergency lending facility was replaced by a consecutive series of emergency lending instruments. The initial temporary emergency facility established in response to the 1997–1998 financial crisis was replaced by a permanent emergency lending category in 2002. It was capped at $6 billion and was in turn replaced by a development sustainability credit line in 2012. This was a contingent credit line whose funds could be withdrawn at a time of a crisis, but it had to be approved before the crisis. It was geared toward providing liquidity during financial distress, while protecting expenditures for programs directed at the poor. It expired in 2015 and was replaced by the special development lending (SDL) instrument in 2017. While the SDL does not require an IDB-specific independent macroeconomic assessment, it is conditional on a country experiencing a macroeconomic crisis and being supported by an existing IMF program. SDL lending cannot exceed $500 million or 2% of a country’s GDP if supported by fresh funds. It can be funded through a reallocation of uncommitted loan balances, provided at least 60% of the remaining uncommitted loan balances are investment loans.

- 1

Three years later that limit was increased to $9.8 billion for 2005–2008, and for the first time a cap was established on disbursements—$7.6 billion for the 4-year period. A ceiling on concessional PBL from the Fund for Special Operations (FSO) was also established ($100 million for the 4-year period). - 2

An IMF on-track program or Article IV (issued within the last 6 months) were de facto requirements to approve and disburse a PBL operation. If an Article IV was more than 6 months old, or if the country had no IMF program or Article IV in place, a letter of comfort from the IMF was usually required. - 3

The PBL lending cap of 30% of total lending applies to lending from IDB’s ordinary capital over consecutive four-year periods. For concessional lending from the FSO the cap is applied on a biannual basis. The temporary increase of the cap to 40% of total lending from the IDB’s ordinary capital applies to the 4-year period ending in December 2022. For FSO resources, the increased PBL cap of 40% applies to lending for 2021–2022.